Finding the cheap auto insurance in Florida is n’t easy. The average cost of auto insurance in Florida has historically been among the most precious in the country, according to NerdWallet’s analysis.

The cheapest car insurance in florida state’s high insurance costs are due to a variety of factors. Florida isn’t only a attraction for hurricanes and crash- related suits, but it also has further business losses and uninsured motorists than utmost countries. Cheapest car insurance in florida’s highways also continue to fill with new residers and excursionists.

But all stopgap isn’t lost. Read on to find the cheapest auto insurance in Florida by age, driving history andmore.However, check out our list of the stylish auto insurance in Florida, If you ’re looking for the stylish bus content.

still, Bests Phone anatomized rates for some of the largest cheapest car insurance in florida metropolises, including If you ’re looking for the cheapest auto insurance near you.

- Fort Lauderdale.

- Jacksonville.

- Miami.

- Orlando.

- St. Petersburg.

- Tampa.

Bests Phone’s tract platoon anatomized auto insurance rates from 10 bus insurers in Florida and listed the five cheapest options for motorists in several age classes and with different histories, all driving a 2021 Toyota Camry LE.

You ’ll find rates for both minimum and full content on this runner. “ minimal content ” is the bare minimal auto insurance you ’re needed to have to drive fairly. In Florida, that means property damage liability and particular injury protection insurance.

Meanwhile, full content insurance offers lesser fiscal protection on the road, but costs further than minimal content. While it’s not needed to drive in Florida, the redundant cost of full content may be worth the peace of mind coming time you hop on I- 4.

Then are the content limits we included in our analysis for full content

- 100,000 fleshly injury liability per person.

- 300,000 fleshly injury liability per accident.

- 50,000 property damage liability per accident.

- 100,000 uninsured automobilist content per person.

- 300,000 uninsured automobilist content per accident.

- Collision content with a$ 1,000 deductible.

- Comprehensive content with a$ 1,000 deductible.

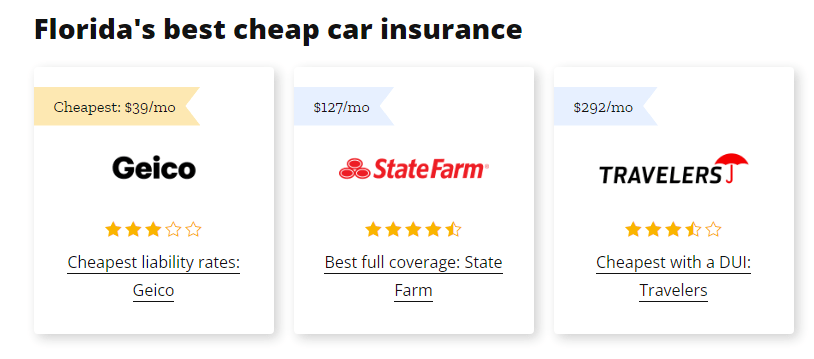

Cheap auto insurance in Florida

Auto insurance is an important purchase, but chancing cheap auto insurance in Florida can feel like trying to find cheap Disney World periodic passes. The stylish way to find cheap auto insurance is to compare rates from multiple insurers.

Use the table below to find the cheapest car insurance in florida auto insurance rates in Florida grounded on your age for both full and minimal content, plus credit and driving history.

Cheapest for 20- time-old motorists

motorists in their 20s may have to get a lot of quotations to find the stylish cheap auto insurance. Prices can be sky-high for youngish 20- somethings, but tend to come down as motorists get further experience on the road. Still, some companies routinely have better insurance decorations for youthful motorists, so it’s stylish to protect around to find them.

Cheapest full content auto insurance in Florida for 20- time- pasts

motorists in Florida with clean driving records may want to consider the following companies, which had the smallest average rates

Geico$ 3,701 per time, or about$ 308 per month.

State Farm$ 5,112 per time, or about$ 426 per month.

Nationwide$ 5,480 per time, or about$ 457 per month.

trippers$ 6,251 per time, or about$ 521 per month.

AIG$ 6,408 per time, or about$ 534 per month.

Cheapest minimum content auto insurance in Florida for 20- time- pasts

motorists in Florida who want just the state minimum content may want to check with these companies, which had the smallest average rates

Geico$ 629 per time, or about$ 52 per month.

trippers$ 1,074 per time, or about$ 89 per month.

Nationwide$ 1,100 per time, or about$ 92 per month.

State Farm$ 1,203 per time, or about$ 100 per month.

Direct bus$ 1,692 per time, or about$ 141 per month.

Cheapest bus insurance in Florida for 20- time- pasts with poor credit

motorists with poor credit in Florida should look at the following insurers with the smallest average rates for minimal content

Geico$ 1,231 per time, or about$ 103 per month.

trippers$ 1,679 per time, or about$ 140 per month.

Direct bus$ 1,692 per time, or about$ 141 per month.

Nationwide$ 1,708 per time, or about$ 142 per month.

AIG$ 1,994 per time, or about$ 166 per month.

Cheapest bus insurance in Florida for 20- time- pasts with one speeding ticket

For motorists with a recent speeding ticket in Florida, then are the companies with the smallest average rates for minimal content

Geico$ 725 per time, or about$ 60 per month.

trippers$ 1,259 per time, or about$ 105 per month.

Nationwide$ 1,433 per time, or about$ 119 per month.

State Farm$ 1,490 per time, or about$ 124 per month.

Direct bus$ 2,086 per time, or about$ 174 per month.

Cheapest bus insurance in Florida for 20- time- pasts with one at- fault crash

For motorists with a recent accident in Florida, then are the companies with the smallest average rates for minimal content

Geico$ 646 per time, or about$ 54 per month.

trippers$ 1,337 per time, or about$ 111 per month.

Nationwide$ 1,338 per time, or about$ 112 per month.

State Farm$ 1,813 per time, or about$ 151 per month.

Direct bus$ 1,974 per time, or about$ 165 per month.

Cheapest bus insurance in Florida for 20- time- pasts after a DUI

The cheapest bus insurance we set up after a DUI is shown then, alongside the insurers’ average rates for minimal content.

Geico$ 975 per time, or about$ 81 per month.

trippers$ 1,606 per time, or about$ 134 per month.

Direct bus$ 1,813 per time, or about$ 151 per month.

Nationwide$ 1,923 per time, or about$ 160 per month.

AIG$ 1,997 per time, or about$ 166 per month.

Cheapest for 30- time-old motorists

By the time they reach their 30s, utmost motorists enjoy cheaper auto insurance decorations than in their teens and 20s. Still, factors like a person’s driving record and auto make and model can increase prices. motorists in their 30s can get lower prices by shopping around and taking advantage of any auto insurance abatements.

Cheapest full content auto insurance in Florida for 30- time- pasts

motorists in Florida with clean driving records may get the smallest rates from these companies

Geico$ 1,825 per time, or about$ 152 per month.

State Farm$ 2,181 per time, or about$ 182 per month.

trippers$ 2,220 per time, or about$ 185 per month.

Nationwide$ 2,838 per time, or about$ 237 per month.

Progressive$ 3,840 per time, or about$ 320 per month.

How to get cheap car insurance in Florida

No matter how old you’re or what your driving history is, there are a many way you can take to get cheapest car insurance in florida auto insurance in Florida. Then are some simple ways to get a better deal

Protect around. Auto insurance companies regularly change their pricing models. That’s why Bests Phone recommends comparing auto insurance quotes from multiple insurers at least formerly a time to get the stylish rate possible.

Ask about abatements. numerous auto insurance companies offer a suite of abatements to allure new guests. It may be worth checking with your insurer to see if there are any auto insurance abatements you may be eligible for that you ’re not presently getting.

Drop gratuitous content. You can lower your auto insurance decorations by getting relieve of voluntary content types you no longer need. For illustration, comprehensive and collision insurance cover repairs for damage to your vehicle in a variety of situations, up to the request value of yourcar.However, you can probably drop these content types, If you enjoy an aged auto that’s not worth important.

Raise your deductible. A auto insurance deductible is the quantum of plutocrat you pay out of fund before your auto insurance kicks in. The advanced your deductible, the lower your auto insurance decoration. Just make sure you have enough plutocrat stockpiled down to cover the advanced quantum. In Florida, you ’ll probably have deductibles for particular injury protection insurance and comprehensive and collision insurance, if you have it.

make your credit. Because auto insurance companies in Florida use a credit- grounded insurance score to price programs, motorists can get a better rate by keeping their credit score grandly.

Minimum car insurance requirements in Florida

At a minimum, Floridians must carry property damage liability and particular injury protection( PIP) in the following quantities

10,000 property damage liability per accident.

10,000 particular injury protection.

Property damage liability insurance covers the cost of other people’s property you damage in a auto accident, up to your policy’s predefined limits.

PIP insurance in Florida covers your medical bills and other charges if you ’re injured in a auto crash, up to your policy limits, no matter whose fault it was.

We recommend buying further than the bare minimum when it comes to all corridor of your bus liability insurance, if you can go it. You might want added protection from voluntary contents similar as collision, comprehensive and uninsured automobilist insurance. For illustration, comprehensive insurance can cover auto damage from flooding, fallen objects and further coming time another Hurricane Ian strikes.